BAD REVENUE

Normally at this time of year Keogh Ryan Tierney Chartered Accountants do an event for business leaders in conjunction with The Timoney Leadership institute www.timoneyleadership.ie . Several years ago it was a fireside chat between Mike Webster, CEO Arvoia and John Killeen, Currently Chairman of Irish Lifeboats and among many achievements he is known for his contribution to bringing the Volvo Ocean Race to Galway. During this discussion, the concept of ‘Bad Revenue’ was raised by Mike and it became one of the talking points of the event. Since then I have often reflected on the concept of bad revenue.

Revenue is the more common title to use now but there are many others. Sales has a more traditional, anglo feel to it. Other names you’ll hear include; Turnover, Income, Top Line, run rate, returns, takings, receipts to name a few. These terms can be misleading as they often have other meanings. So be careful.

When we recognise revenue can often be complicated and challenged. Revenue recognition can be a problem for growth companies that enter contracts with customers where the income flow doesn’t match the costs or commitments. Of course, rules can be used to your advantage, but you may find yourself in an argument with your accountant / auditor when you want to recognise the full value of a contract you have just signed.

So what’s Bad Revenue? Surely all income is good? Any of you who have been in business long enough will chuckle as you think back on those customers / clients / contracts / products that turned out to be much more effort than you anticipated. This is a particular mistake that early stage businesses make. I certainly did. When we are under pressure to make progress, we take on business that we are often overqualified to deliver on and we lower our standards. This ties us up and distracts us from working with good customers who deserve more attention and who we can learn more from to grow our business.

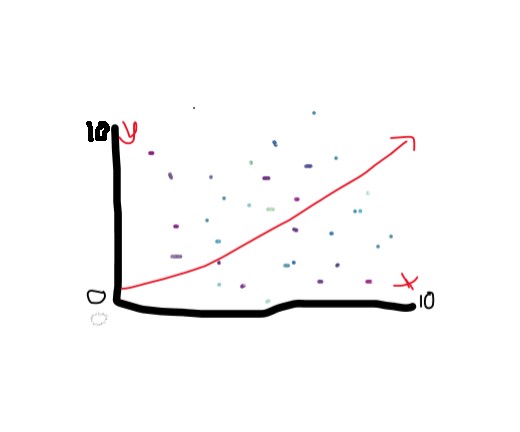

Twenty years ago, I worked in France and I got a revealing lesson in the concept of ‘Bad Revenue’. I was looking at an acquisition of a Belgian business with a CEO of a Sheet Plastics business based in Lyon (one of our products was Ski’s for Salamon). When we looked at the Targets customer base during the due diligence the CEO cursed and started to laugh. The customer list was full of old customers of his that he had removed from his current business. He drew the following chart for me and explained the process he had gone through to remove them.

He had asked his accounts team to list all their customers and rate them from 0 to 10 on financial strength, 10 being financially strong. He then asked his sales & production team to rate the customers on difficulty to deal with; 10 being very difficult to deal with. He put the results together and charted them as above putting financial strength on the Y axis and difficulty to deal with on the X axis. Then he drew the red line – any customer below the red line got pushed out; they were financially weak and if they were financially strong they were increasingly difficult to deal with. Top left-hand corner was the ideal customer, anything below the line was ‘Bad Revenue’. These customers had now turned up in the Belgian acquisition target and he was dismayed at the thought of having to go through the same process again.

I have come across other examples of this approach. I know a Chartered Accountant in Dublin who keeps a list on his desk and if he goes to make a call to a client and has a heavy heart making the call, he puts the client name on the list. At the end of the year he removes 5% of his clients using this list, freeing up time to spend on clients he likes working with.

I am aware of another business that deployed a process which they called ‘Project Guillotine’ aimed at removing customers that were not a good fit for the business. In our own business we had a process ten years ago which we called ‘Up or Out’. The objective was to get the client recovery up or move on the client. In the end we did not move too many on, but it helped us focus on what was a suitable client for the business.

Ideally you do not want to have to deploy these types of processes so if you are growing your business aggressively make sure you are growing with the right revenue. If your business is stable and growing gently then maybe it is time to have a look at your revenue and think about it in terms of good and bad. Those customers or clients that do not fill you with joy are probably bad revenue and need to be removed – Marie Kondo for business!

Remember, to Know Your Business, you must Know Your Numbers.

Leave a Reply